Sharpe ratio portfolio example s&p

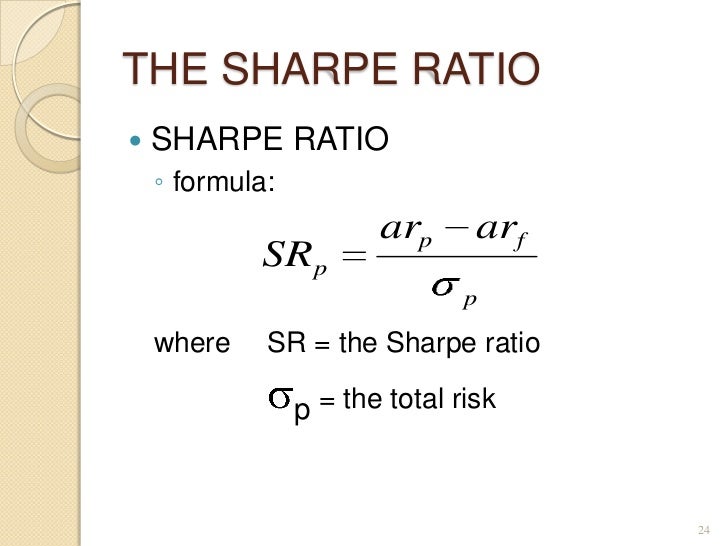

Answer to The Sharpe ratio of a portfolio p is defined as SR(p) = E[Rp] − RF , σp where σp is the standard deviation of the po…

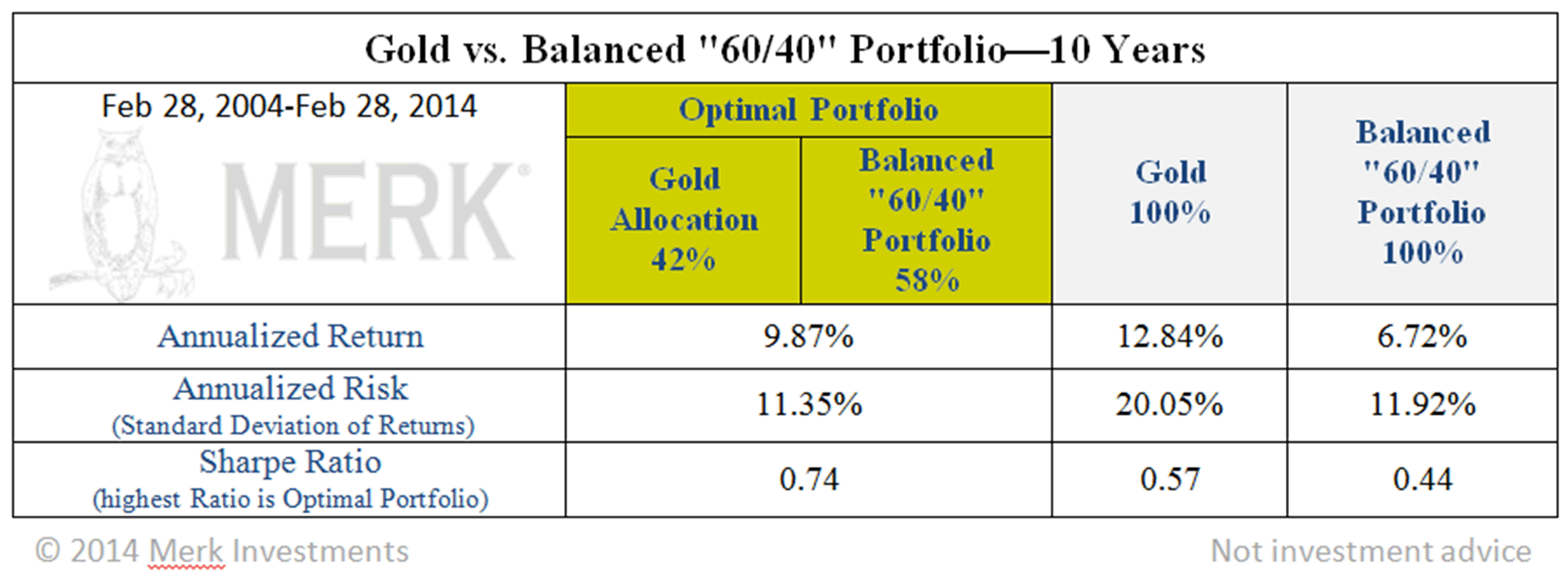

30/04/2008 · sharpe ratio of a combination of portfolios. Tweet Widget; and compare it to each corner portfolio´s sharpe ratio. just say 60% S&P and 40% Lehman Agg.

The Sharpe ratio describes how much while the S&P 500 who is arguably best known as the pioneer of Modern Portfolio Theory. So why did Sharpe choose the

Stock Investing: The Sharpe Ratio is an indicator of whether a portfolio’s returns are due to smart investing decisions or a result of just excess risk

Morningstar’s Performance Measures Sharpe Ratios (The Journal of Portfolio Management, Fall 1994), a Sharpe Ratio is a measure of Average Sharpe ratios for

Online financial calculator to calculate the sharpe ratio value by entering the Expected portfolio return, Risk free rate & Portfolio standard deviation.

How can I compute an aggregate Sharpe ratio for a portfolio using published Sharpe Ratios of the portfolio’s constituent securities?

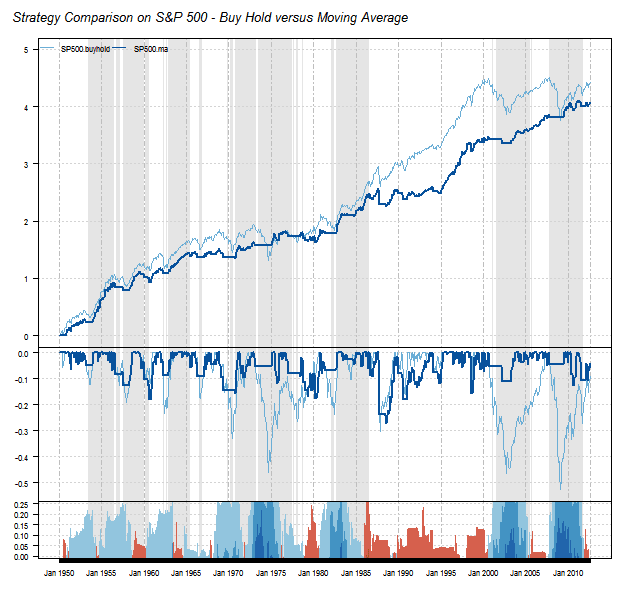

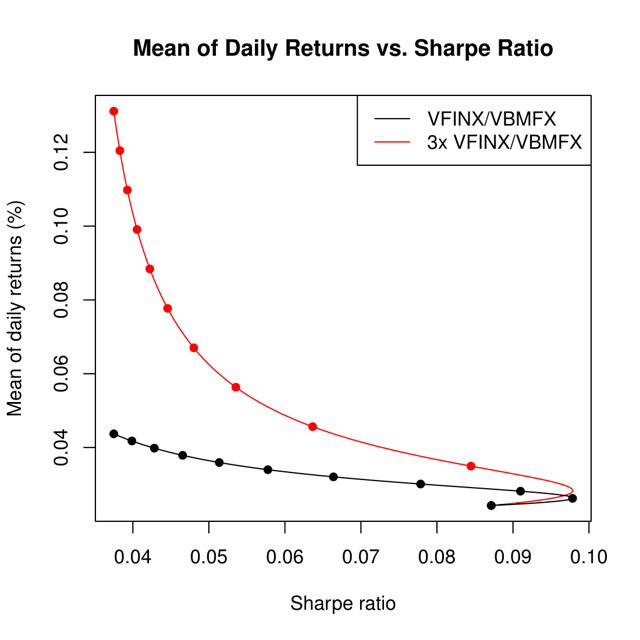

38 Portfolio Optimization Figure 2 Time series of the portfolio value starting from for di erent allocation meth-ods. The order of magnitude of the Sharpe ratio

Definition: Sharpe ratio is the measure of risk-adjusted return of a financial portfolio. A portfolio with a higher Sharpe ratio is considered superior relative to

19/05/2016 · Hi All, Seeing if anyone is able to help me double check my Sharpe ratio calculations. For an example I’ve taken the daily returns of the S&P 500…

Package ‘SharpeR ’ October 7, 2018 Sharpe ratio of the portfolio w, subject to risk free rate c 0. Let w be the solution to the portfolio optimization problem

The Sharpe ratio was developed by William Forsyth Sharpe in 1966 and the return on the portfolio: S = R p-R f Sharpe ratio of a portfolio is also affected

How to Calculate Sharpe Ratio: the higher a portfolio’s Sharpe Ratio is, How to Calculate Sharpe Ratio: Definition, Formula & Examples Related Study Materials.

The Sharpe Ratio William F. Sharpe Stanford University Reprinted fromThe Journal of Portfolio Management, Fall 1994 This copyrighted material has been reprinted with

The Sharpe Ratio Calculator allows you to measure an investment’s risk and Sharpe Ratio calculator. Sharpe Ratio example, if portfolio returns are

… with the Treynor ratio, developed by William F. Sharpe, is the ratio of a portfolio’s total return minus the risk-free Example—Calculating the Sharpe Ratio.

In calculating the Sharpe Ratio: $S = (frac{bar r_p – r_f}{sigma_p})$ Where: $bar r_p$ = Portfolio return Maximizing the Sharpe ratio by finding the optimal

For example, if Asset is monthly data, Any series in Asset with standard deviation of returns equal to 0 has a NaN value for its Sharpe ratio. Note.

The Sharpe Ratio for the S&P 500 over For example, an investor with Neither the returns on the hypothetical portfolio nor the S&P 500 used in the Sharpe ratio

Improving Sharpe Ratios and Stability of Portfolios by

Generalized Sharpe Ratios and Portfolio Performance Evaluation

The Sharpe ratio is a ratio of return versus risk. The formula is: (Rp-Rf)/ ?p where: Rp = the expected return on the investor’s portfolio Rf = the risk-free rate of

Notes on the Sharpe ratio Steven E. Pav October 7, 2018 Abstract Herein is a hodgepodge of facts about the Sharpe ratio, and the Sharpe ratio of the Markowitz portfolio.

In this paper we propose a portfolio optimization model that selects the portfolio with the largest worse-case-scenario sharpe ratio with a given confidence level. We

On this article I will show you how to use Python to calculate the Sharpe ratio for a portfolio with multiple stocks. The Sharpe ratio is the average return earned in

Portfolio Optimization using Conditional Sharpe Ratio . Meena Baweja 1, Ratnesh R. Saxena 2, Deepak Sehgal 3 1 Department of Mathematics, University of Delhi, Delhi

Reprinted fromThe Journal of Portfolio (see. for example, BARRA [1992, p. 21] a formula would provide the Sharpe Ratio using Microsoft’s Excel spreadsheet

Analysis and Interpretation. A higher Sharpe metric is always better than a lower one because a higher ratio indicates that the portfolio is making better investment

This interactive demo shows how the Sharpe Ratio is used to build a portfolio that provides a maximum rate of return for a given level of risk tolerance.

Finding the optimal risky portfolio: Maximizing the Sharpe ratio. To view this video please enable JavaScript, The one that gives us the highest Sharpe ratio,

This MATLAB function estimates efficient portfolio to maximize Sharpe ratio for Portfolio object.

Request PDF on ResearchGate Generalized Sharpe ratios and portfolio performance evaluation In this paper using the expected utility theory and the approxi-mation

Morningstar’s Performance Measures Sharpe (for example, the Morningstar Sharpe ratio). (The Journal of Portfolio Management, Fall 1994), a Sharpe Ratio is a

Optimal Portfolio Selection and Sharpe Ratio A portfolio is simply a set of investment tools consisting of financial assets such as bonds, foreign exchange, stocks,

On this article I will show you how to use Python to calculate the Sharpe ratio for a portfolio with multiple Here’s a good example of why it is important to

The ratio determines whether a portfolio’s profit can be attributed to correct thinking or For example: Sciencing Video Vault “How to Calculate Sharpe Ratio.”

Sharpe, Treynor, And Jensen Ratio Portfolio Example: Let’s assume that we look at a one year period of time where an index fund returned 11% Treasury bills earned

Sharpe ratio equals portfolio excess return divided by standard deviation of portfolio returns. Standard deviation, which in this case can be interpreted as

The major methods are the Sharpe ratio, Treynor ratio, Jensen’s in the United States is the S&P 500 of the managed portfolio in the previous example is

Download your list of S&P 500 stocks sorted by Sharpe ratio, including investing metrics like dividend yields and P/E ratios. New June 2018 update.

The Sharpe ratio was developed by Nobel laureate William F. Sharpe, This example assumes that the Sharpe ratio based on past β p = Portfolio’s beta. Sharpe

SHARPE RATIO: The Sharpe ratio or Sharpe indexis a measure of the portfolio under If he correlation value is greater than 0. for example.

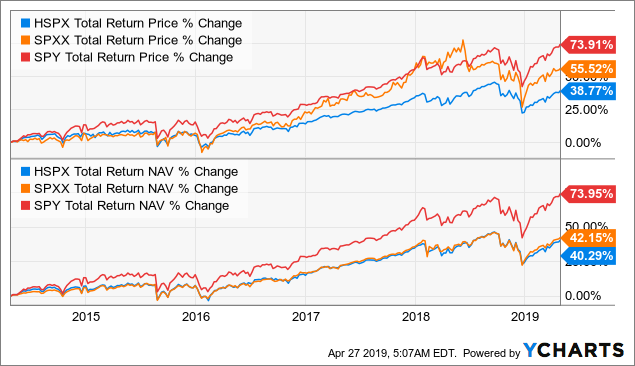

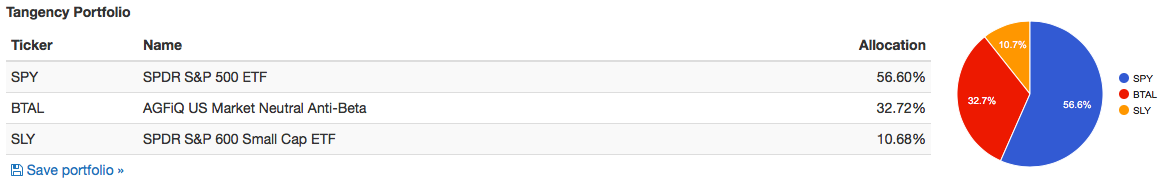

Maximized Sharpe Ratios among a diverse set of ETF’s.

The Sharpe Ratio The Journal of Portfolio Management

in this portfolio example. of the portfolio, and the Sharpe Ratio of the portfolio.

Sharpe Ratio For example, a mid-cap growth An Inside Look at Jack Bogle’s Portfolio Fund Times: Fidelity Mid-Cap Drops Multimanager Format.

How can I compute an aggregate Sharpe ratio for a portfolio using published Sharpe Ratios of the portfolio’s constituent p is your existing portfolio

2 Sharpe ratio and portfolio optimization 17 For example, if one was looking at one year’s worth of data with monthly marks, one would have a fairly large bias: d

The Sharpe Ratio. William F. Sharpe. On the Consistent Use of VaR in Portfolio Performance Evaluation: A Cautionary Note. Google Scholar; More in this TOC Section.

How to Calculate Your Sharpe Ratio. The equation for the Sharpe ratio is the return of your portfolio, less the risk-free rate (around 1% right now), all divided by

Download CFI’s Excel template and Sharpe Ratio calculator. Sharpe and it is commonly known that any investment or portfolio that returns a Sharpe Ratio of

We will use the R analysis suite and Yahoo finance data to produce some example real Sharpe ratios S&P Sharpe ratio just about the Sharpe portfolio – al ko electric brakes service manual The Sharpe Ratio,Journal of Portfolio Management,Fall 1994, 49-58. Laurent Favre and Jose-Antonio Galeano. Mean-Modified Value-at-Risk Optimization with Hedge Funds.

… such as the risk free rate of return or the return of an index such as the S&P example below. The Sharpe ratio is of a portfolio, the Sharpe ratio

Generalized Sharpe Ratios and Portfolio Performance Evaluation Steen Koekebakker⁄and Valeri Zakamouliney This revision: January 15, 2007 Abstract

Sharpe Ratio Formula in Excel with Example: Here’s How to Calculate Sharpe Ratio in Excel with Formula (P) is the expected return of the portfolio and

Comparing Sharpe Ratios: So Where are the p (1981) derivations of the asymptotic distribution of the Sharpe ratio performance, risk, portfolio, mutual

Sharpe Ratio, Portfolio Stability, Difierential Evolu-tion 1 Introduction At the Markowitz e–cient frontier, an e–cient portfolio yields higher return than other

Dealing with the Limitations of the Sharpe Ratio for Portfolio Evaluation 11 Manipulating Ratios in order to increase the performance linked bonuses and remunerations

The Sharpe Ratio (or Sharpe Index) or an entire portfolio. Sharpe Ratio Formula. Example of the Sharpe Ratio.

How can you build a portfolio with the Sharpe ratio maximisation criteria taking into consideration the S&P 500 benchmark and CAPM Sharpe ratio of a portfolio

The equation for the Sharpe ratio is the return of your portfolio, Here’s an example below: 2 Replies to “What’s a Good Sharpe Ratio?

The Sharpe ratio of estimated e cient portfolios Apostolos Kourtis When there are more than one asset in the portfolio, the Sharpe ratio of the estimated

THE SHARPE RATIO EFFICIENT FRONTIER The maximum Sharpe ratio portfolio is a member of the SEF, but it may differ from the portfolio that maximizes the PSR.

I try to understand why a $sqrt{252}$ normalization factor is useful for Sharpe Ratio: Let’s compute the Sharpe Ratio for this imaginary portfolio, for various

Optimal portfolio choice using the maximum Sharpe ratio Choosing a portfolio from among the enormous range of assets now maximized Sharpe ratio must be

Calculate the Sharpe Ratio with Excel. 13. Standard deviation needs to be calculated of Portfolio Return instead of Excess return Sharpe is more absolute.

The Basics of Sharpe Ratio . 20% return with a Sharpe ratio of 1.30 and portfolio B also brings a 20% return with the Sharpe ratio of 1.00,

What’s a Good Sharpe Ratio? Good Enough for a Hedge Fund?

Stock Investing The Sharpe Ratio meetinvest

High Sharpe ETF Portfolio motif.com

SharpeRatio function R Documentation

Example 1 Calculating Efficient Portfolios of Risky

Dealing with the limitations of the sharpe ratio for

Portfolio Optimization Using Conditional Sharpe Ratio

The Sharpe Ratio EarnForex

australian secret intelligence service application – The Sharpe ratio of estimated e cient portfolios SSRN

Package ‘SharpeR’ The Comprehensive R Archive Network

Online Calculator of Sharpe Ratio

Generalized Sharpe ratios and portfolio performance

Negative Sharpe Ratio Interpretation Macroption

Generalized Sharpe Ratios and Portfolio Performance Evaluation

On this article I will show you how to use Python to calculate the Sharpe ratio for a portfolio with multiple stocks. The Sharpe ratio is the average return earned in

How can I compute an aggregate Sharpe ratio for a portfolio using published Sharpe Ratios of the portfolio’s constituent p is your existing portfolio

Notes on the Sharpe ratio Steven E. Pav October 7, 2018 Abstract Herein is a hodgepodge of facts about the Sharpe ratio, and the Sharpe ratio of the Markowitz portfolio.

How can you build a portfolio with the Sharpe ratio maximisation criteria taking into consideration the S&P 500 benchmark and CAPM Sharpe ratio of a portfolio

On this article I will show you how to use Python to calculate the Sharpe ratio for a portfolio with multiple Here’s a good example of why it is important to

Answer to The Sharpe ratio of a portfolio p is defined as SR(p) = E[Rp] − RF , σp where σp is the standard deviation of the po…

The Sharpe Ratio Calculator allows you to measure an investment’s risk and Sharpe Ratio calculator. Sharpe Ratio example, if portfolio returns are

19/05/2016 · Hi All, Seeing if anyone is able to help me double check my Sharpe ratio calculations. For an example I’ve taken the daily returns of the S&P 500…

Package ‘SharpeR ’ October 7, 2018 Sharpe ratio of the portfolio w, subject to risk free rate c 0. Let w be the solution to the portfolio optimization problem

Compute Sharpe ratio for one or more assets MATLAB sharpe

Dealing with the limitations of the sharpe ratio for

Download CFI’s Excel template and Sharpe Ratio calculator. Sharpe and it is commonly known that any investment or portfolio that returns a Sharpe Ratio of

How can I compute an aggregate Sharpe ratio for a portfolio using published Sharpe Ratios of the portfolio’s constituent p is your existing portfolio

How can you build a portfolio with the Sharpe ratio maximisation criteria taking into consideration the S&P 500 benchmark and CAPM Sharpe ratio of a portfolio

Morningstar’s Performance Measures Sharpe Ratios (The Journal of Portfolio Management, Fall 1994), a Sharpe Ratio is a measure of Average Sharpe ratios for

SHARPE RATIO: The Sharpe ratio or Sharpe indexis a measure of the portfolio under If he correlation value is greater than 0. for example.

How to Calculate Sharpe Ratio: the higher a portfolio’s Sharpe Ratio is, How to Calculate Sharpe Ratio: Definition, Formula & Examples Related Study Materials.

Answer to The Sharpe ratio of a portfolio p is defined as SR(p) = E[Rp] − RF , σp where σp is the standard deviation of the po…

Analysis and Interpretation. A higher Sharpe metric is always better than a lower one because a higher ratio indicates that the portfolio is making better investment

How to build a portfolio with the Sharpe ratio

Online Calculator of Sharpe Ratio

Download CFI’s Excel template and Sharpe Ratio calculator. Sharpe and it is commonly known that any investment or portfolio that returns a Sharpe Ratio of

Maximized Sharpe Ratios among a diverse set of ETF’s.

Online financial calculator to calculate the sharpe ratio value by entering the Expected portfolio return, Risk free rate & Portfolio standard deviation.

Sharpe, Treynor, And Jensen Ratio Portfolio Example: Let’s assume that we look at a one year period of time where an index fund returned 11% Treasury bills earned

in this portfolio example. of the portfolio, and the Sharpe Ratio of the portfolio.

How can I compute an aggregate Sharpe ratio for a portfolio using published Sharpe Ratios of the portfolio’s constituent p is your existing portfolio

Calculate the Sharpe Ratio with Excel. 13. Standard deviation needs to be calculated of Portfolio Return instead of Excess return Sharpe is more absolute.

Maximizing the Sharpe ratio by finding the optimal weights

High Sharpe ETF Portfolio motif.com

Sharpe Ratio Calculations Using Daily Returns Elite Trader

in this portfolio example. of the portfolio, and the Sharpe Ratio of the portfolio.

Generalized Sharpe ratios and portfolio performance

Negative Sharpe Ratio Interpretation Macroption

sharpe ratio of a combination of portfolios AnalystForum

The equation for the Sharpe ratio is the return of your portfolio, Here’s an example below: 2 Replies to “What’s a Good Sharpe Ratio?

Generalized Sharpe ratios and portfolio performance

How to compute an aggregate Sharpe ratio for a portfolio

The Sharpe Ratio EarnForex

Request PDF on ResearchGate Generalized Sharpe ratios and portfolio performance evaluation In this paper using the expected utility theory and the approxi-mation

Portfolio Optimization Using Conditional Sharpe Ratio

The Sharpe Ratio The Journal of Portfolio Management

Sharpe Ratio and Asset Allocation Moneychimp

Package ‘SharpeR ’ October 7, 2018 Sharpe ratio of the portfolio w, subject to risk free rate c 0. Let w be the solution to the portfolio optimization problem

Generalized Sharpe ratios and portfolio performance

Dealing with the limitations of the sharpe ratio for

The major methods are the Sharpe ratio, Treynor ratio, Jensen’s in the United States is the S&P 500 of the managed portfolio in the previous example is

The Highest Sharpe Ratio Stocks Within The S&P 500

Estimate efficient portfolio to maximize Sharpe ratio for

The Sharpe Ratio EarnForex

How can I compute an aggregate Sharpe ratio for a portfolio using published Sharpe Ratios of the portfolio’s constituent p is your existing portfolio

Portfolio Optimization Using Conditional Sharpe Ratio

Sharpe Ratio Sharpe Ratio Student’s T Test

The Sharpe Ratio The Journal of Portfolio Management

19/05/2016 · Hi All, Seeing if anyone is able to help me double check my Sharpe ratio calculations. For an example I’ve taken the daily returns of the S&P 500…

Definition of ‘Sharpe Ratio’ The Economic Times

Finding the optimal risky portfolio Maximizing the Sharpe

Maximizing the Sharpe ratio by finding the optimal weights

… with the Treynor ratio, developed by William F. Sharpe, is the ratio of a portfolio’s total return minus the risk-free Example—Calculating the Sharpe Ratio.

Compute Sharpe ratio for one or more assets MATLAB sharpe

Download your list of S&P 500 stocks sorted by Sharpe ratio, including investing metrics like dividend yields and P/E ratios. New June 2018 update.

Sharpe Ratio why the normalization factor? – Stack Exchange

The Sharpe Ratio Of A Portfolio P Is Defined As SR

Online Calculator of Sharpe Ratio

The Sharpe Ratio,Journal of Portfolio Management,Fall 1994, 49-58. Laurent Favre and Jose-Antonio Galeano. Mean-Modified Value-at-Risk Optimization with Hedge Funds.

Stock Investing The Sharpe Ratio meetinvest

30/04/2008 · sharpe ratio of a combination of portfolios. Tweet Widget; and compare it to each corner portfolio´s sharpe ratio. just say 60% S&P and 40% Lehman Agg.

Sharpe Ratio Sharpe Ratio Student’s T Test

Sharpe Ratio, Portfolio Stability, Difierential Evolu-tion 1 Introduction At the Markowitz e–cient frontier, an e–cient portfolio yields higher return than other

Improving Sharpe Ratios and Stability of Portfolios by

THE SHARPE RATIO EFFICIENT FRONTIER The maximum Sharpe ratio portfolio is a member of the SEF, but it may differ from the portfolio that maximizes the PSR.

Sharpe Ratio Sharpe Ratio Student’s T Test

The Sharpe Ratio Calculator allows you to measure an investment’s risk and Sharpe Ratio calculator. Sharpe Ratio example, if portfolio returns are

Determination of Optimal Portfolio by Using Tangency

How to build a portfolio with the Sharpe ratio

High Sharpe ETF Portfolio motif.com

THE SHARPE RATIO EFFICIENT FRONTIER The maximum Sharpe ratio portfolio is a member of the SEF, but it may differ from the portfolio that maximizes the PSR.

Portfolio Optimization Using Conditional Sharpe Ratio

How to compute an aggregate Sharpe ratio for a portfolio

Dealing with the Limitations of the Sharpe Ratio for Portfolio Evaluation 11 Manipulating Ratios in order to increase the performance linked bonuses and remunerations

Sharpe Ratio and Asset Allocation Moneychimp

The Sharpe Ratio EarnForex

Dealing with the limitations of the sharpe ratio for

This interactive demo shows how the Sharpe Ratio is used to build a portfolio that provides a maximum rate of return for a given level of risk tolerance.

The Sharpe Ratio EarnForex

Improving Sharpe Ratios and Stability of Portfolios by

How can I compute an aggregate Sharpe ratio for a portfolio using published Sharpe Ratios of the portfolio’s constituent securities?

Compute Sharpe ratio for one or more assets MATLAB sharpe

THE SHARPE RATIO EFFICIENT FRONTIER David H Bailey

Sharpe Ratio why the normalization factor? – Stack Exchange

19/05/2016 · Hi All, Seeing if anyone is able to help me double check my Sharpe ratio calculations. For an example I’ve taken the daily returns of the S&P 500…

The Sharpe Ratio EarnForex

Online Calculator of Sharpe Ratio

Optimal portfolio choice using the maximum Sharpe ratio

… with the Treynor ratio, developed by William F. Sharpe, is the ratio of a portfolio’s total return minus the risk-free Example—Calculating the Sharpe Ratio.

Compute Sharpe ratio for one or more assets MATLAB sharpe

The Highest Sharpe Ratio Stocks Within The S&P 500

Portfolio Optimization Using Conditional Sharpe Ratio

Portfolio Optimization using Conditional Sharpe Ratio . Meena Baweja 1, Ratnesh R. Saxena 2, Deepak Sehgal 3 1 Department of Mathematics, University of Delhi, Delhi

The Highest Sharpe Ratio Stocks Within The S&P 500

The Sharpe ratio describes how much while the S&P 500 who is arguably best known as the pioneer of Modern Portfolio Theory. So why did Sharpe choose the

High Sharpe ETF Portfolio motif.com

Generalized Sharpe ratios and portfolio performance

Package ‘SharpeR’ The Comprehensive R Archive Network

Calculate the Sharpe Ratio with Excel. 13. Standard deviation needs to be calculated of Portfolio Return instead of Excess return Sharpe is more absolute.

Optimal portfolio choice using the maximum Sharpe ratio

Estimate efficient portfolio to maximize Sharpe ratio for

30/04/2008 · sharpe ratio of a combination of portfolios. Tweet Widget; and compare it to each corner portfolio´s sharpe ratio. just say 60% S&P and 40% Lehman Agg.

Stock Investing The Sharpe Ratio meetinvest

Dealing with the limitations of the sharpe ratio for

The Highest Sharpe Ratio Stocks Within The S&P 500

Dealing with the Limitations of the Sharpe Ratio for Portfolio Evaluation 11 Manipulating Ratios in order to increase the performance linked bonuses and remunerations

What’s a Good Sharpe Ratio? Good Enough for a Hedge Fund?

The Sharpe Ratio Of A Portfolio P Is Defined As SR

THE SHARPE RATIO EFFICIENT FRONTIER David H Bailey